Financial Regulation Explained: Ensuring Compliance Worldwide

- Nurlan Mamedov

- 6 hours ago

- 6 min read

Managing financial compliance in fast-moving sectors like fintech and cryptocurrency can feel overwhelming when regulations shift across jurisdictions and products. Startups aiming for growth need to navigate the demands of investor protection, market integrity, and systemic risk management while staying flexible as laws and technology change. This guide breaks down the essentials so compliance officers can understand the critical features of financial regulation and steer clear of common myths that hinder responsible innovation.

Table of Contents

Key Takeaways

Point | Details |

Financial Regulation Purpose | Financial regulation safeguards investors, ensures market integrity, and mitigates systemic risks while fostering a responsible business environment. |

Dynamic Regulatory Frameworks | Regulatory systems are adaptive, evolving with technological advancements and emerging financial challenges, necessitating ongoing compliance efforts. |

High-Risk Sector Compliance | Sectors like fintech and cryptocurrency require robust compliance strategies that integrate anti-money laundering policies, data privacy, and operational risk management. |

Risks of Non-Compliance | Failing to meet regulatory standards can lead to severe financial penalties, operational disruptions, and lasting reputational damage, emphasising the need for proactive compliance management. |

Defining financial regulation and common myths

Financial regulation represents a sophisticated legal framework designed to manage and oversee financial markets, institutions, and transactions. Comprehensive systemic risk management involves complex policies that protect economic stability and consumer interests across multiple jurisdictions.

At its core, financial regulation serves several critical functions:

Protect investors and consumers from fraudulent practices

Maintain the integrity of financial markets

Ensure transparency in financial transactions

Mitigate systemic risks that could destabilise entire economic systems

Prevent money laundering and illegal financial activities

Contrary to popular misconceptions, financial regulation is not about stifling innovation but creating a structured environment where businesses can operate responsibly. Regulatory frameworks are dynamic systems that evolve with technological and economic changes, adapting to new challenges in the financial landscape.

Many professionals mistakenly believe financial regulation is a static, bureaucratic process. However, principles of financial regulation demonstrate a nuanced, purposive approach that considers the entire financial ecosystem rather than applying rigid, inflexible rules.

Pro tip: Always consult specialised legal professionals when navigating complex financial regulatory requirements to ensure full compliance and mitigate potential risks.

Regulatory types: fintech, crypto, gambling

Regulatory approaches for emerging financial sectors like fintech, cryptocurrency, and gambling represent increasingly complex legal landscapes that demand sophisticated oversight. Innovative financial technology regulations must balance technological advancement with robust consumer protection mechanisms.

Each sector presents unique regulatory challenges:

Fintech Regulation

Focuses on technological innovation in financial services

Addresses digital payment platforms

Monitors cybersecurity risks

Ensures transparent digital transactions

Cryptocurrency Regulation

Manages decentralised financial instruments

Prevents potential money laundering

Establishes clear reporting frameworks

Protects investor interests

Gambling Regulation

Controls gambling market operations

Prevents fraudulent practices

Implements responsible gambling protocols

Manages financial transactions

Interestingly, comparative market regulation reveals surprising parallels between gambling and financial markets, particularly regarding risk management and behavioural psychology.

These regulatory frameworks are not static but dynamic systems continuously adapting to technological shifts and emerging financial products. Regulatory compliance demands ongoing monitoring, sophisticated risk assessment, and proactive policy development.

Here’s a concise comparison of regulatory focuses across key financial sectors:

Sector | Primary Oversight Areas | Strategic Compliance Needs |

Fintech | Digital service security | Strong data protection |

Cryptocurrency | Asset transparency | Enhanced anti-fraud systems |

Gambling | Responsible conduct | Rigorous licence adherence |

This summary highlights how regulations target different core risks and require tailored compliance strategies for each sector.

Pro tip: Engage specialised legal consultants who understand the nuanced regulatory requirements across different financial sectors to ensure comprehensive compliance strategies.

Key features and global legal frameworks

Global financial regulation represents a complex network of interconnected legal systems designed to manage increasingly sophisticated financial landscapes. Comparative financial regulatory approaches reveal intricate mechanisms for harmonising international financial governance across diverse jurisdictions.

Key features of modern global legal frameworks include:

International Cooperation

Collaborative policy development

Cross-border information sharing

Standardised reporting mechanisms

Unified risk management strategies

Regulatory Objectives

Protecting investor interests

Preventing financial crimes

Maintaining market stability

Promoting transparent transactions

Ensuring fair competitive environments

The contemporary regulatory landscape is characterised by dynamic adaptation to technological and societal changes. Global financial services regulations increasingly focus on emerging challenges such as digital assets, artificial intelligence, and operational resilience.

Understanding these frameworks requires recognising their nuanced, evolving nature. Regulatory compliance is not a static concept but a continuous process of alignment with changing global standards and technological innovations.

Pro tip: Develop a proactive compliance strategy that anticipates regulatory shifts and maintains flexibility across multiple jurisdictional requirements.

Compliance obligations for high-risk sectors

High-risk financial sectors such as fintech, cryptocurrency, and online gambling demand rigorous regulatory compliance strategies that go beyond standard operational protocols. Global regulatory compliance strategies emphasise comprehensive approaches to managing complex regulatory landscapes.

Key compliance obligations for high-risk sectors include:

Anti-Money Laundering (AML) Requirements

Implement robust transaction monitoring systems

Conduct thorough customer due diligence

Establish clear reporting mechanisms

Maintain detailed transactional records

Data Privacy and Cybersecurity

Develop comprehensive data protection protocols

Ensure encrypted communication channels

Implement multi-factor authentication

Conduct regular security audits

Operational Risk Management

Create detailed risk assessment frameworks

Develop incident response strategies

Maintain continuous regulatory training

Establish transparent governance structures

Regulatory compliance frameworks are increasingly designed to balance consumer protection with innovative business development. Compliance strategies must remain adaptive, recognising the dynamic nature of high-risk financial environments.

Successful navigation of these complex requirements demands a proactive, comprehensive approach that anticipates regulatory shifts and maintains organisational resilience.

Pro tip: Invest in specialised compliance expertise and develop flexible technological infrastructure that can rapidly adapt to evolving regulatory landscapes.

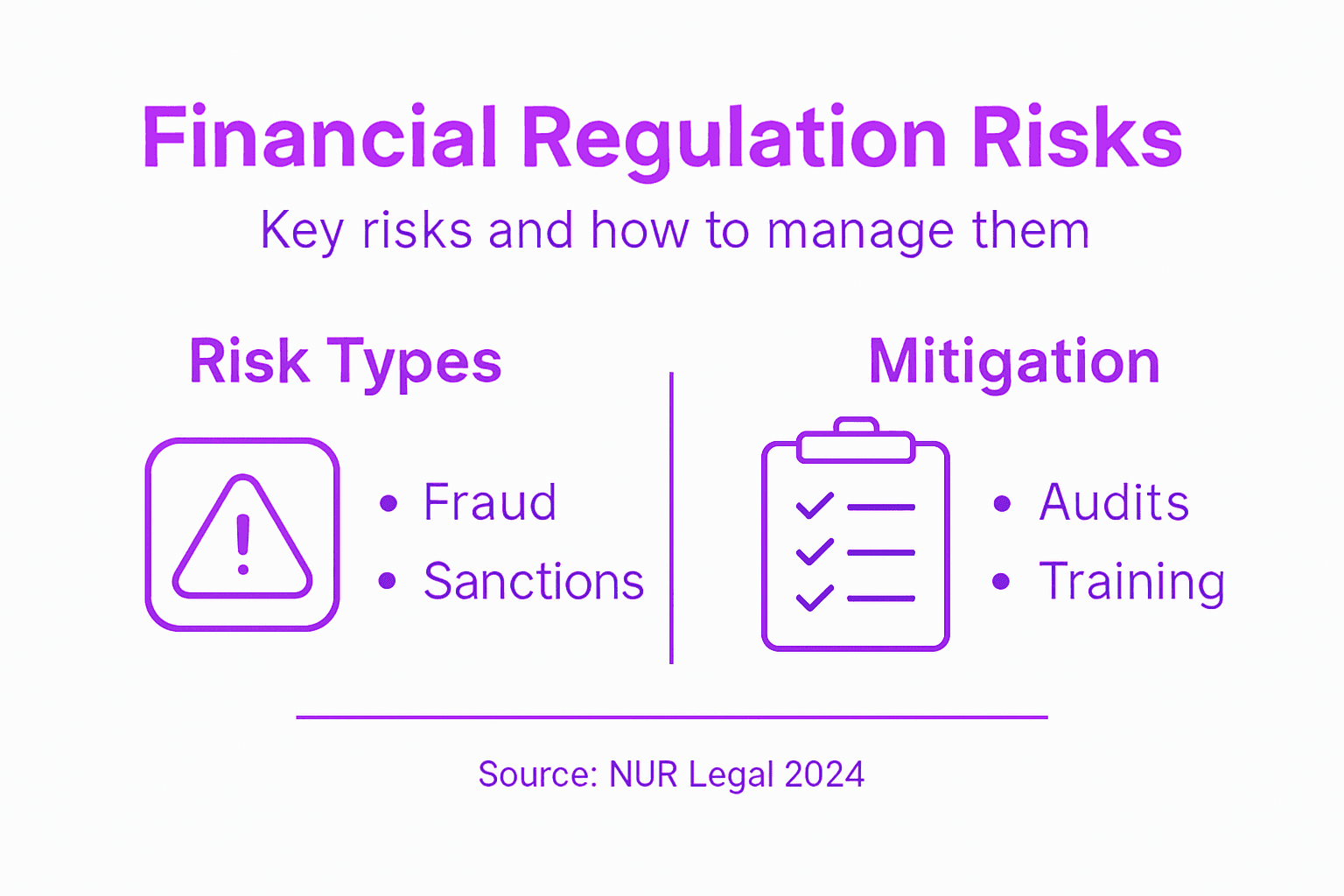

Risks, penalties, and common pitfalls

Financial regulatory landscapes are fraught with complex risks that can potentially devastate organisations unprepared for comprehensive compliance management. Managing compliance obligations requires sophisticated strategies to mitigate potential financial and reputational damages.

Key risks and potential penalties include:

Financial Penalties

Substantial monetary fines

Potential revenue forfeitures

Regulatory sanctions

Unexpected compliance costs

Operational Disruptions

Temporary business suspension

Mandatory operational restructuring

Loss of operational licences

Enforced external audits

Reputational Consequences

Significant brand damage

Reduced investor confidence

Negative media exposure

Potential client attrition

Non-compliance consequences demonstrate that regulatory breaches extend far beyond immediate financial repercussions. Compliance risks represent systemic challenges that require proactive, comprehensive management approaches.

Successful risk mitigation demands continuous monitoring, robust internal controls, and a culture of transparency that anticipates and addresses potential regulatory vulnerabilities before they escalate.

Below is a summary of common regulatory risks and the business impact for organisations:

Risk Type | Business Impact | Mitigation Priority |

Financial penalties | Reduced profits and cashflow | Immediate |

Operational losses | Interrupted services | Strategic |

Reputational harm | Lost trust, market share | Long-term |

Organisations should prioritise mitigation strategies according to the severity and duration of each risk’s impact.

Pro tip: Develop a dynamic compliance framework with regular internal audits and comprehensive staff training to identify and mitigate potential regulatory risks proactively.

Navigate Complex Financial Regulation with Expert Legal Support

Financial regulation demands continuous attention to compliance obligations, especially in high-risk industries like fintech, cryptocurrency, and gambling. This article highlights the challenges organisations face in adapting to evolving regulatory frameworks, managing anti-money laundering requirements, and mitigating operational risks while avoiding severe penalties and reputational harm. Businesses need reliable guidance to stay ahead in this dynamic landscape where transparency, investor protection, and regulatory alignment are critical.

At NUR Legal, we understand these complexities and offer tailored solutions to help startups and established companies secure licences, conduct contract reviews, and establish compliant operations worldwide. Our expertise in obtaining crypto licences in Georgia and Seychelles, as well as affordable gaming licences from Curaçao or Anjouan, empowers clients to build legally sound foundations with confidence. Don’t let regulatory uncertainty hold your business back.

Discover how our specialised legal consultancy can facilitate your compliance strategy and protect your financial ventures from costly oversights.

Unlock your path to compliance today.

Explore our full suite of services at NUR Legal and take the first step towards compliant, efficient, and transparent financial operations. Connect with our experts now to receive personalised assistance in navigating licensing and regulatory challenges across jurisdictions.

Frequently Asked Questions

What is financial regulation?

Financial regulation is a legal framework designed to oversee financial markets, institutions, and transactions, ensuring stability, transparency, and protection for investors and consumers.

Why is financial regulation important for businesses?

Financial regulation establishes guidelines that promote ethical practices, prevent fraud, and mitigate systemic risks, enabling businesses to operate within a structured environment which fosters consumer trust.

What are the key obligations for compliance in high-risk sectors?

High-risk sectors must comply with anti-money laundering requirements, data privacy protocols, and operational risk management strategies to ensure robust governance and protect against regulatory breaches.

How can companies effectively manage compliance risks?

Companies can manage compliance risks by implementing continuous monitoring practices, developing a dynamic compliance framework, and investing in staff training to ensure awareness and preparedness for regulatory changes.

Recommended