Role of Legal Support in Fintech Success

- Nurlan Mamedov

- Dec 6, 2025

- 7 min read

Most british fintech companies now face stricter legal expectations than ever before. With regulations constantly shifting, staying compliant is not just about ticking boxes. Over 90 percent of fintech leaders cite regulatory risk as a top operational concern, making legal support essential for sustainable growth. This guide unpacks the vital role of legal expertise, from day-to-day compliance to handling cross-border licensing, so you can protect your business and stay ahead in a competitive global market.

Table of Contents

Key Takeaways

Point | Details |

Legal Support is Essential | Fintech operations require sophisticated legal frameworks to navigate complex regulatory landscapes and ensure compliance with evolving standards. |

Dynamic Regulatory Environment | Global legal frameworks for fintech are diverse, necessitating adaptable strategies that can respond to rapid technological changes and jurisdictional requirements. |

Comprehensive Risk Management | Effective risk management strategies must address various legal liabilities, including technological, regulatory, and operational vulnerabilities, to ensure organisational sustainability. |

Licensing and Compliance as Strategic Tools | Approaching licensing and compliance dynamically allows fintech businesses to turn regulatory requirements into competitive advantages rather than viewing them as mere administrative tasks. |

Defining Legal Support in Fintech Operations

Legal support in fintech operations represents a sophisticated framework of strategic guidance designed to navigate the complex regulatory landscapes of digital financial services. At its core, legal support provides a comprehensive shield protecting businesses from potential regulatory risks while facilitating compliant and sustainable growth.

The conceptual evolution of fintech legal frameworks has become increasingly nuanced, particularly as digital financial technologies challenge traditional regulatory paradigms. Academic research reveals that legal support now encompasses far more than traditional compliance mechanisms, emerging as a critical strategic function that addresses multifaceted challenges in global markets.

Key components of legal support in fintech operations typically include:

Regulatory compliance management

Risk mitigation strategies

Licensing and authorisation guidance

Contractual framework development

Intellectual property protection

Cross-jurisdictional legal advisory services

The primary objective of legal support is to transform complex regulatory requirements into actionable business strategies. Experienced legal professionals understand that successful fintech operations demand more than mere adherence to rules—they require proactive legal architecture that anticipates potential challenges and creates robust protective mechanisms.

Navigating the intricate legal terrain of fintech demands specialised knowledge across multiple domains. Businesses must recognise that legal support is not a static service but a dynamic, evolving partnership that adapts to technological innovations and shifting regulatory landscapes. By integrating comprehensive legal strategies, fintech enterprises can establish a solid foundation for sustainable growth and operational excellence.

Categories of Legal Support Required

Fintech organisations require a comprehensive legal support framework that addresses multiple critical domains, ensuring robust protection and strategic operational alignment. Legal categories in fintech are not monolithic but represent intricate, interconnected systems designed to mitigate risks and facilitate innovative financial technologies.

Advanced technological research highlights the necessity of dynamic regulatory approaches, particularly in emerging domains such as artificial intelligence and innovative financial platforms. These legal categories must be sufficiently flexible to accommodate rapid technological transformations while maintaining stringent compliance standards.

Key legal support categories include:

Regulatory Compliance Support

Monitoring evolving financial regulations

Ensuring adherence to jurisdiction-specific requirements

Developing comprehensive compliance strategies

Risk Management Legal Services

Identifying potential legal vulnerabilities

Creating risk mitigation frameworks

Implementing proactive legal defence mechanisms

Licensing and Authorisation Guidance

Navigating complex licensing processes

Securing appropriate operational permissions

Managing international regulatory documentation

Contractual and Intellectual Property Protection

Drafting robust technological service agreements

Protecting innovative financial technologies

Managing intellectual property rights

The sophistication of legal support categories reflects the increasingly complex technological ecosystem within fintech. Businesses must recognise that these legal frameworks are not static bureaucratic requirements but dynamic strategic tools that enable innovative financial service delivery.

Navigating these legal categories requires specialised expertise that transcends traditional legal practice. Modern fintech legal support demands a holistic understanding of technological innovation, regulatory landscapes, and strategic business objectives. By developing comprehensive legal support frameworks, organisations can transform potential regulatory challenges into opportunities for sustainable growth and technological advancement.

Legal Frameworks Governing Fintech Globally

Global legal frameworks governing fintech represent a complex tapestry of regulatory mechanisms designed to address the unique challenges posed by digital financial technologies. Regulatory complexity has become increasingly pronounced as financial innovations outpace traditional legislative approaches, creating a dynamic landscape that demands sophisticated and adaptive legal strategies.

The international regulatory environment for fintech is characterised by significant variations across different jurisdictions, with each region developing its own nuanced approach to technological financial services. While some countries adopt progressive, innovation-friendly frameworks, others maintain more conservative regulatory stances that prioritise consumer protection and systemic stability.

Key elements of global fintech legal frameworks typically include:

Regulatory Scope

Defining technological financial services

Establishing clear operational boundaries

Identifying specific regulatory requirements

Compliance Mechanisms

Implementing robust monitoring systems

Developing reporting protocols

Establishing enforcement procedures

Risk Management Protocols

Addressing cybersecurity challenges

Managing financial crime risks

Protecting consumer interests

Technological Innovation Governance

Creating adaptive regulatory sandboxes

Supporting responsible technological development

Balancing innovation with regulatory oversight

The international legal landscape for fintech requires businesses to develop comprehensive regulatory strategies that can navigate multiple jurisdictional requirements. Successful organisations must remain agile, continuously adapting their legal frameworks to accommodate emerging technological trends and evolving regulatory expectations.

Ultimately, global legal frameworks for fintech represent a delicate balance between fostering technological innovation and maintaining financial system integrity. Businesses must approach these frameworks not as restrictive barriers but as strategic opportunities to demonstrate compliance, build trust, and differentiate themselves in an increasingly competitive digital financial marketplace.

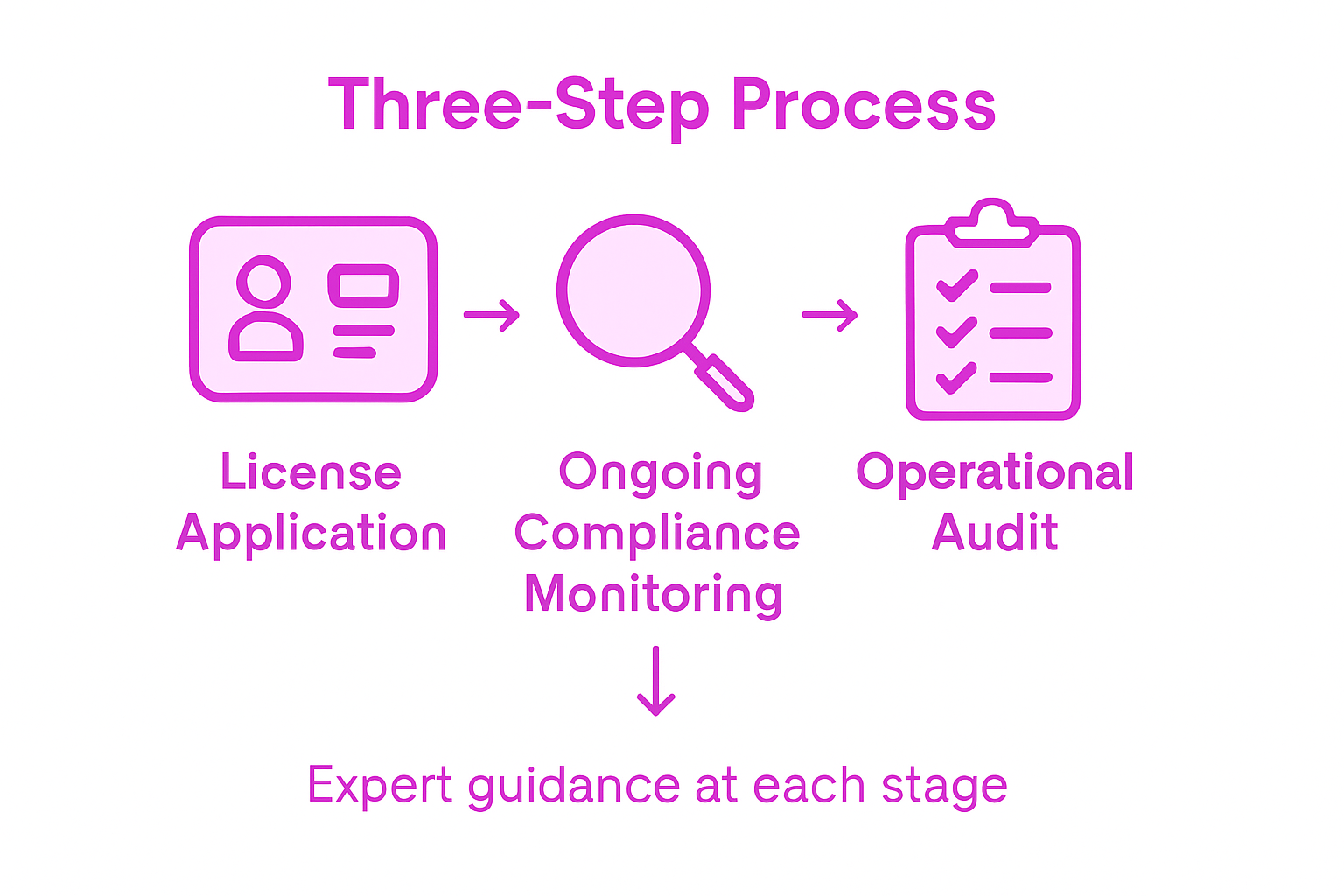

Licensing, Compliance, and Operational Requirements

Fintech organisations must navigate a complex landscape of licensing requirements that fundamentally shape their operational capabilities and legal legitimacy. Recent research highlights the critical importance of developing flexible regulatory frameworks that can accommodate rapidly evolving technological innovations while maintaining rigorous compliance standards.

The operational requirements for fintech businesses encompass a multifaceted approach to regulatory adherence, involving intricate processes that extend far beyond traditional financial service models. These requirements demand comprehensive strategies that integrate technological innovation with robust legal safeguards, ensuring businesses can demonstrate both operational excellence and regulatory alignment.

Key operational and compliance dimensions include:

Licensing Prerequisites

Comprehensive documentation preparation

Demonstrating financial stability

Proving technological infrastructure reliability

Regulatory Compliance

Implementing sophisticated monitoring systems

Developing comprehensive risk management protocols

Maintaining transparent operational processes

Operational Governance

Establishing clear internal control mechanisms

Creating robust reporting frameworks

Ensuring ongoing regulatory alignment

Technical Infrastructure Requirements

Maintaining secure technological platforms

Implementing advanced cybersecurity measures

Developing scalable operational systems

Businesses seeking to secure Lithuanian payment institution licenses must recognise that operational requirements represent more than bureaucratic hurdles. These frameworks are strategic tools designed to protect both organisational interests and broader financial ecosystem integrity.

Successful fintech organisations approach licensing and compliance as dynamic, strategic processes rather than static administrative tasks. By developing comprehensive, adaptable operational frameworks, businesses can transform regulatory challenges into opportunities for demonstrating professional excellence and building stakeholder confidence in an increasingly complex digital financial landscape.

Risks, Liabilities, and Common Pitfalls

Fintech organisations encounter a complex landscape of legal risks that demand sophisticated strategic management and proactive mitigation approaches. Emerging research on technological liability highlights the critical importance of developing comprehensive frameworks for addressing potential legal and operational challenges in rapidly evolving digital financial environments.

Advanced legal technology analyses demonstrate that contemporary fintech enterprises must navigate multifaceted liability scenarios that extend far beyond traditional financial service risk management. These challenges require nuanced understanding of technological, regulatory, and operational interdependencies that can significantly impact organisational sustainability.

Critical risk categories include:

Technological Liability Risks

System security vulnerabilities

Data protection breaches

Algorithmic decision-making errors

Regulatory Compliance Risks

Jurisdictional regulatory violations

Inadequate reporting mechanisms

Non-compliance with evolving standards

Operational Vulnerability Risks

Insufficient internal control frameworks

Ineffective risk management protocols

Inadequate cybersecurity infrastructure

Financial and Reputational Risks

Potential financial compensation requirements

Reputation damage from regulatory actions

Loss of operational licences

Businesses must recognise that risk management represents a dynamic, ongoing process requiring continuous adaptation and strategic foresight. Successful organisations develop robust internal mechanisms that anticipate potential challenges and create comprehensive mitigation strategies.

Navigating the intricate landscape of fintech risks demands a holistic approach that integrates technological innovation, legal expertise, and strategic foresight. By developing sophisticated risk management frameworks, businesses can transform potential vulnerabilities into opportunities for demonstrating operational excellence and building stakeholder confidence in an increasingly complex digital financial ecosystem.

Secure Your Fintech Future with Expert Legal Support

Fintech ventures face the challenge of navigating complex regulatory requirements while driving innovation and growth. This article highlights key pain points such as regulatory compliance management, licensing intricacies, risk mitigation strategies, and adapting to shifting legal frameworks—all critical elements that can make or break your business success. Legal support is not just about ticking boxes but building a resilient and agile foundation that anticipates risks and enables sustainable operations across multiple jurisdictions.

At NUR Legal, we specialise in tailored legal consultancy specifically designed for fintech and other high-risk industries. We understand the urgency of transforming regulatory complexities into clear, compliant pathways. Our comprehensive services include corporate licensing guidance, compliance strategies, contract review, and global company formation. With our strong relationships with regulators worldwide, we empower startups and established businesses alike to secure vital licences such as crypto licensing in Georgia and Seychelles or full gaming licences in Curaçao and Anjouan.

Take control of your fintech compliance journey today by partnering with the trusted experts at NUR Legal. Explore how our bespoke legal solutions can safeguard your innovations and accelerate your market entry with confidence.

Ready to simplify licensing and compliance challenges in your fintech operations?

Visit https://nur-legal.com now to discover how our specialised legal support can help you achieve operational excellence and regulatory success. Don’t let legal hurdles slow down your growth—act now to secure your position in this competitive landscape.

Frequently Asked Questions

What is the importance of legal support in fintech operations?

Legal support is crucial in fintech operations as it provides strategic guidance to navigate complex regulatory environments, mitigates risks, and ensures compliance with legal frameworks, enabling sustainable business growth.

What are the key components of legal support in fintech?

Key components include regulatory compliance management, risk mitigation strategies, licensing and authorisation guidance, contractual framework development, intellectual property protection, and cross-jurisdictional legal advisory services.

How do fintech companies manage regulatory compliance?

Fintech companies manage regulatory compliance by monitoring evolving regulations, ensuring adherence to jurisdiction-specific requirements, and developing comprehensive compliance strategies tailored to their operational needs.

What are the common legal risks faced by fintech organisations?

Common legal risks include technological liability risks such as data breaches, regulatory compliance risks from jurisdictional violations, operational vulnerability risks due to insufficient internal controls, and financial and reputational risks stemming from regulatory actions.

Recommended

Comments