Role of Compliance Officer – Safeguarding High-Risk Sectors

- Nurlan Mamedov

- Dec 9, 2025

- 6 min read

Most british companies face growing scrutiny as global regulations become more complex and unforgiving. With fines exceeding billions for regulatory breaches in the United Kingdom alone, the stakes for appointing an effective compliance officer have never been higher. Understanding the true responsibilities and impact of this often-misunderstood role is crucial for businesses that want to operate safely and ethically in rapidly changing industries. This guide explores what defines an outstanding compliance officer, the vital skills required, and the everyday realities of safeguarding organisational integrity.

Table of Contents

Key Takeaways

Point | Details |

Compliance Officer’s Role | Compliance Officers are essential in high-risk industries, ensuring adherence to legal and ethical standards while managing intricate regulatory landscapes. |

Core Competencies | Successful compliance professionals possess a blend of analytical thinking, strong communication skills, and technological proficiency to navigate regulatory requirements effectively. |

Legal Frameworks | Compliance Officers must have comprehensive knowledge of dynamic legal frameworks, including AML, KYC, and data protection regulations, to safeguard organisational integrity. |

Daily Responsibilities | Their day-to-day tasks involve continuous risk assessments, policy updates, and staff training to maintain compliance and mitigate potential breaches efficiently. |

Defining the Compliance Officer Role and Purpose

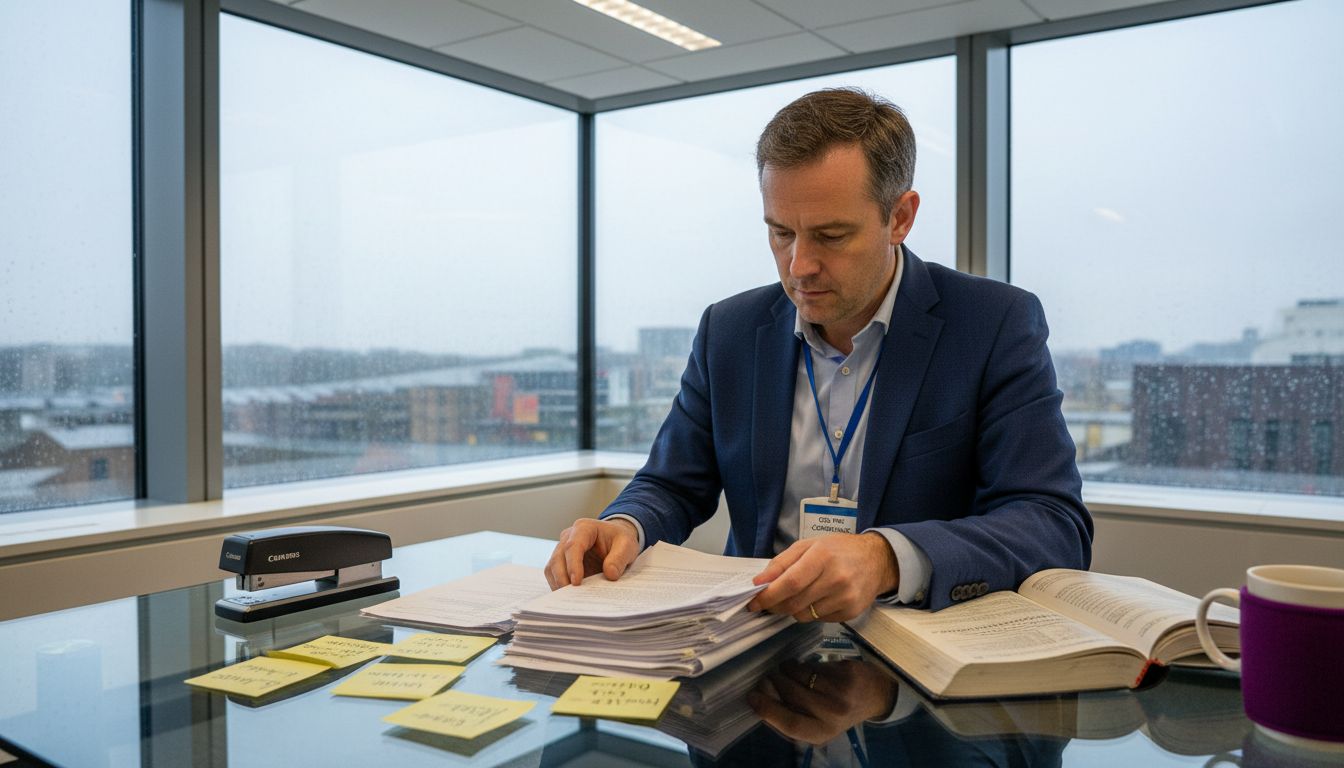

The compliance officer serves as a critical guardian within high-risk and regulated industries, acting as the organisational sentinel who ensures legal and ethical standards are consistently maintained. Developing comprehensive compliance frameworks represents a fundamental responsibility that demands meticulous attention to regulatory requirements and internal policies.

At its core, the compliance officer’s role encompasses several strategic dimensions. These professionals are tasked with managing complex regulatory landscapes across sectors like fintech, gambling, cryptocurrency, and financial services. They conduct rigorous risk assessments, monitor regulatory changes, and design robust internal control mechanisms that protect organisations from potential legal vulnerabilities. Implementing dynamic compliance management systems allows these experts to proactively identify and mitigate potential risks before they escalate.

The key responsibilities of a compliance officer typically include:

Developing and implementing comprehensive compliance programmes

Conducting periodic risk assessments and internal audits

Maintaining detailed documentation and reporting mechanisms

Training staff on regulatory requirements and ethical standards

Liaising with external regulatory bodies and legal authorities

Ultimately, the compliance officer represents more than a regulatory checkpoint. They are strategic partners who transform complex legal frameworks into actionable organisational strategies, ensuring businesses can operate confidently within intricate regulatory environments while maintaining the highest standards of professional integrity.

Core Skills and Competencies Required in Compliance

Compliance professionals operate in complex regulatory environments that demand a sophisticated blend of technical expertise and nuanced interpersonal capabilities. Conducting proportionate compliance checks requires a multifaceted skill set that goes far beyond mere technical knowledge.

The foundational competencies of an exceptional compliance officer encompass several critical domains. Analytical thinking and adaptability emerge as paramount skills, enabling professionals to navigate rapidly shifting regulatory landscapes. These experts must demonstrate an extraordinary capacity for detailed analysis, quickly interpreting complex regulatory frameworks and translating them into actionable organisational strategies.

Key skills and competencies for compliance professionals include:

Advanced analytical reasoning

Exceptional communication capabilities

Robust risk assessment techniques

Deep understanding of regulatory frameworks

Conflict resolution and negotiation skills

Technological proficiency in compliance management systems

Ethical decision-making capabilities

Beyond technical proficiencies, successful compliance officers must cultivate a strategic mindset that balances meticulous regulatory adherence with practical business objectives. They serve as crucial bridge-builders between legal requirements and organisational functionality, transforming complex regulations into coherent, implementable strategies that protect both institutional interests and broader ethical standards.

Legal Frameworks Governing Compliance Officers

Compliance officers navigate intricate legal landscapes that demand comprehensive understanding of multifaceted regulatory requirements across different industries and jurisdictions. Staying informed about legislative changes and supervisory guidance represents a critical mandate that requires continuous professional vigilance and strategic adaptability.

The legal frameworks governing compliance professionals typically encompass multiple regulatory domains, including anti-money laundering (AML) regulations, know-your-customer (KYC) protocols, data protection standards, and sector-specific compliance requirements. These frameworks are not static documents but dynamic systems that evolve in response to emerging technological challenges, global economic shifts, and increasingly complex business environments.

Key legal framework components include:

International regulatory standards

Sector-specific compliance guidelines

Financial reporting requirements

Data protection and privacy legislation

Corporate governance regulations

Ethical conduct and transparency mandates

Navigating these intricate legal landscapes requires more than technical knowledge. Compliance officers must develop a holistic understanding of regulatory intent, interpreting complex legal language and translating abstract principles into practical organisational strategies. Their role extends beyond mere rule-following, emerging as critical strategic partners who protect organisational integrity while enabling sustainable business growth within robust legal boundaries.

Day-to-Day Responsibilities in High-Risk Industries

Compliance officers in high-risk sectors operate in dynamic environments that demand exceptional vigilance, strategic thinking, and proactive risk management. Conducting comprehensive risk assessments and monitoring compliance programmes represents a critical daily responsibility that requires meticulous attention to emerging regulatory challenges across industries such as fintech, cryptocurrency, online gambling, and financial services.

The daily workflow of a compliance professional involves a complex array of strategic and operational tasks. These typically include continuous regulatory scanning, internal policy development, staff training, documentation management, and direct engagement with both internal stakeholders and external regulatory bodies. Professionals must seamlessly integrate technological monitoring tools with human analytical capabilities, creating robust systems that can detect and mitigate potential compliance breaches before they escalate.

Key daily responsibilities encompass:

Performing real-time risk assessments

Updating compliance documentation and policy frameworks

Investigating potential regulatory violations

Developing and delivering compliance training programmes

Maintaining detailed audit trails and reporting mechanisms

Monitoring transactions for suspicious activities

Implementing technological compliance tracking systems

Beyond routine tasks, compliance officers serve as critical organisational guardians, translating complex regulatory requirements into practical, implementable strategies. Their role extends far beyond simple rule enforcement, positioning them as strategic partners who balance regulatory adherence with organisational growth and operational efficiency across challenging and dynamic business landscapes.

Risks, Liabilities, and Common Pitfalls for Compliance Officers

Compliance professionals operate within high-stakes environments where even minor oversights can result in substantial legal and financial consequences. The landscape of regulatory risk is constantly evolving, demanding unprecedented levels of vigilance and strategic foresight from those responsible for organisational integrity.

Addressing inadequate training programmes and insufficient monitoring mechanisms represents a critical challenge that can expose organisations to significant operational risks. These systemic vulnerabilities can manifest through multiple channels, potentially leading to regulatory penalties, reputational damage, and substantial financial liabilities.

Key risks and potential pitfalls include:

Incomplete or outdated compliance documentation

Inadequate staff training and awareness programmes

Ineffective risk assessment and monitoring protocols

Lack of technological infrastructure for compliance tracking

Poor communication with regulatory authorities

Insufficient record-keeping and audit trail maintenance

Failure to adapt to rapidly changing regulatory landscapes

Successful compliance officers must develop a proactive, anticipatory approach to risk management. This involves not only understanding current regulatory requirements but also cultivating robust predictive capabilities that allow organisations to stay ahead of emerging regulatory challenges. Their role transcends traditional rule enforcement, positioning them as strategic architects of organisational resilience and ethical governance.

Empower Your Compliance Strategy with Expert Legal Support

Navigating the complex role of a compliance officer in high-risk sectors like fintech and gambling requires more than just understanding regulations. The article highlights critical challenges including developing robust compliance frameworks, managing evolving legal landscapes, and preventing costly pitfalls such as inadequate training and insufficient monitoring. Ensuring your organisation remains proactive and resilient demands expert guidance that transforms regulatory complexity into clear, actionable strategies.

At NUR Legal, we specialise in supporting compliance officers and businesses by providing tailored legal consultancy and licensing services. Whether you need assistance with obtaining crypto, gambling, or financial licences in multiple jurisdictions or require expert legal opinions and contract reviews, our team offers trusted solutions designed to help you meet stringent compliance demands efficiently and transparently. Start your journey towards secure, legally compliant operations today by visiting our website and explore how we can help safeguard your business with industry-leading expertise.

Frequently Asked Questions

What are the primary responsibilities of a compliance officer?

Compliance officers are tasked with developing and implementing comprehensive compliance programmes, conducting periodic risk assessments and internal audits, maintaining documentation, training staff on regulatory requirements, and liaising with external regulatory bodies.

What core skills are essential for a successful compliance officer?

Key skills include advanced analytical reasoning, exceptional communication abilities, robust risk assessment techniques, in-depth understanding of regulatory frameworks, and strong conflict resolution and negotiation skills.

How do compliance officers navigate complex legal frameworks?

Compliance officers must stay informed about legislative changes and supervisory guidance, interpret complex legal language, and translate abstract regulatory principles into actionable organisational strategies to ensure legal compliance and maintain institutional integrity.

What are the common risks faced by compliance officers in high-risk sectors?

Common risks include incomplete or outdated compliance documentation, inadequate staff training, ineffective risk assessment protocols, lack of technological infrastructure for compliance tracking, poor communication with regulatory authorities, and insufficient record-keeping practices.

Recommended

Comments